Franchise Tax

The 2008-2009 New York State Budget Act has drastically altered the way that franchise taxes will be determined for businesses. Last night CBS 6 News reported that the Tax Changes Anger Small Businesses. A Mr. Subb franchise owner in the Capital Region had his franchise tax jump from $425 last year to $3,000 this year. The franchise tax used to be based on payroll and is now based on receipts.

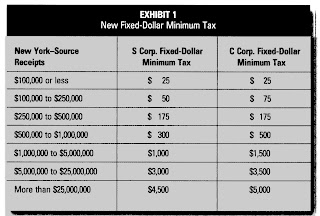

A more in depth article was published on January 1st, 2009 in the CPA Journal. Written by Mark H. Levin, a copy of the article can be found here. The below tables were found in the original article.

A more in depth article was published on January 1st, 2009 in the CPA Journal. Written by Mark H. Levin, a copy of the article can be found here. The below tables were found in the original article.

Comments

This is a 1300% increase over the fee I paid last year and the straw that broke this camel's back.

In protest of this,I am laying off one employee the day I write this check. I know this seems like a harsh move but the idiots in Albany just DO NOT GET IT. Without the few small businesses actually stupid enough to stay in NY, this State is dead. They remind me of the last Russian Roulette scene in "Deer Hunter" - they know there's a bullet in a chamber but they just keep pulling the trigger with no expectation that the gun will actually fire.